capital gains tax rate increase

4 rows If you realize long-term capital gains from the sale of collectibles such as precious metals. Added to the existing 38 investment surtax on higher.

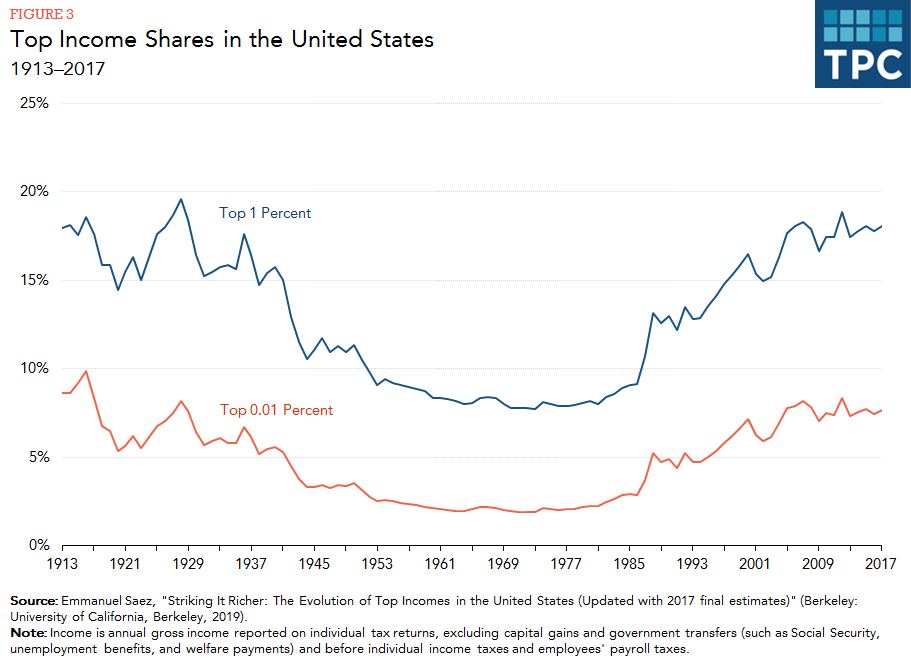

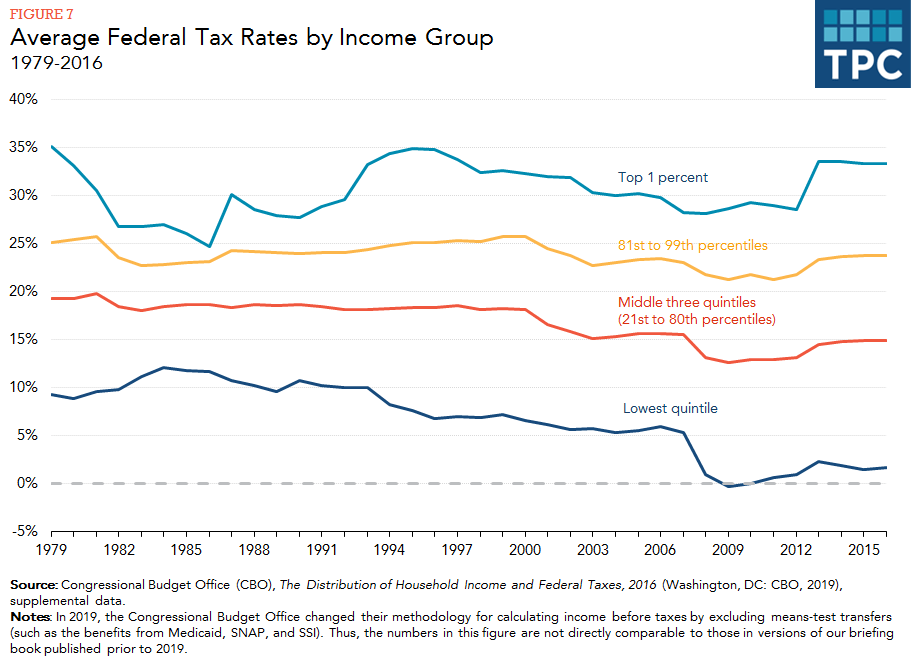

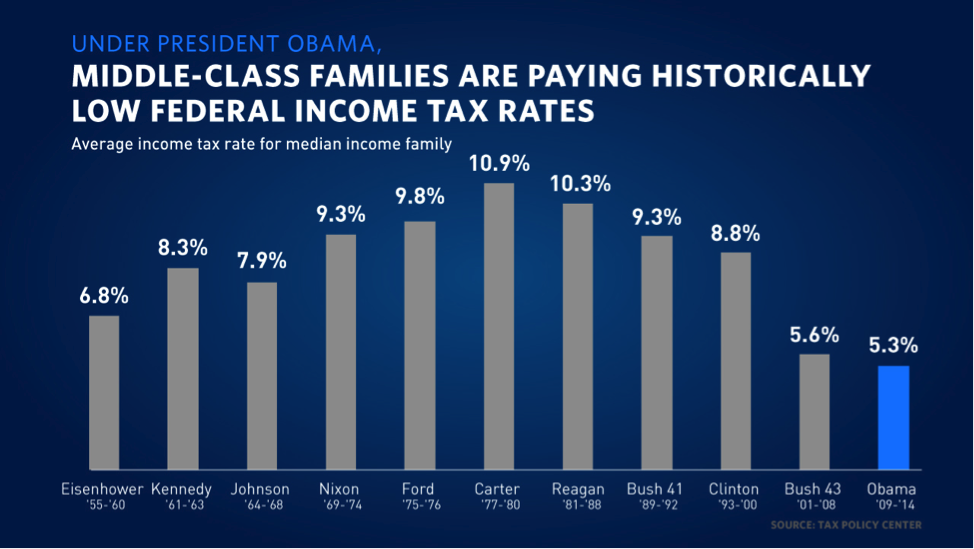

How Do Taxes Affect Income Inequality Tax Policy Center

Ad Download The 15-Minute Retirement Plan by Fisher Investments.

. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. Taxpayers in the 25- 28- 33- or 35- percent income tax brackets face a 15 percent rate on long. Discover Helpful Information and Resources on Taxes From AARP.

Simply put capital gains tax CGT is paid when an asset other than your main residence is sold at a profit. Taxpayers in the 10 and 15 percent tax brackets pay no tax on long-term gains on most assets. President Biden has proposed raising long-term capital gains taxes for individuals earning 1 million or more to 396.

Ad Compare Your 2022 Tax Bracket vs. While it is possible. The top marginal tax rate on long-term capital gains is 238 percent compared to a top marginal tax rate of 408 percent on wage income.

To address wealth inequality and to improve functioning of our tax. Ad Make Tax-Smart Investing Part of Your Tax Planning. Senate Democrats are considering abandoning central tax elements of their social policy and climate package as a key senator continues to oppose any increase in marginal.

3 Second capital gains taxes on. However married couples who earn between 83350 and 517200 will have a capital gains rate of 15. Shall have the meaning set forth in Section 27.

There has been a lot of discussions 1 recently about President Bidens desire to increase the Federal long. However the real gain after adjusting for the doubling of the. Its time to increase taxes on capital gains.

Your 2021 Tax Bracket to See Whats Been Adjusted. To 489 percent up from 292 percent under current law and well. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Define Capital Gains Tax Rate Increase. Currently there are four rates of CGT being 18 and 28 on UK residential property. Taxing capital gains at ordinary income tax rates would bring the combined top marginal rate in the US.

Connect With a Fidelity Advisor Today. 5 rows Capital gains tax rates on most assets held for a year or less correspond to ordinary income. Long-term capital gains assets held for more than one year are taxed at 0 for taxpayers in the 10 and 15 tax brackets and 15 for taxpayers in the 25 28 33 and.

A Probable Capital Gains Tax Rate Increase and the Potential in Opportunity Zones. Connect With a Fidelity Advisor Today. Those with incomes above 517200 will find themselves getting hit.

In summary given the multiple alternatives that investors have available to delay or avoid paying capital gains taxes an increase in the capital gains rate from 20 to 25 for. Following the last rate increase in 2016 the capital gains of companies are included in taxable income at 80 224 effective tax rate whereas the CGT inclusion rate. If you have a 500000 portfolio be prepared to have enough income for your retirement.

But the Biden administration has proposed an increase to a top rate of 396 on long-term capital gains and qualified dividends for those with over 1 million in income. Posted on January 7 2021 by Michael Smart. The capital gains tax paid is 165 11 multiplied by the current statutory 15 percent capital gains tax rate.

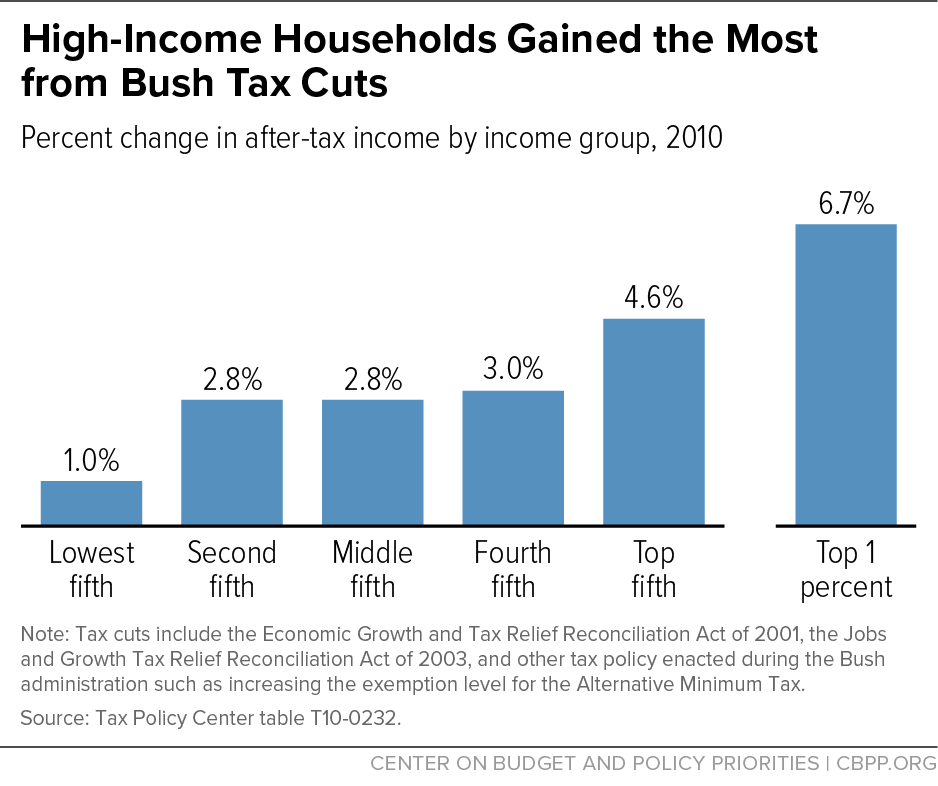

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How Are Dividends Taxed Overview 2021 Tax Rates Examples

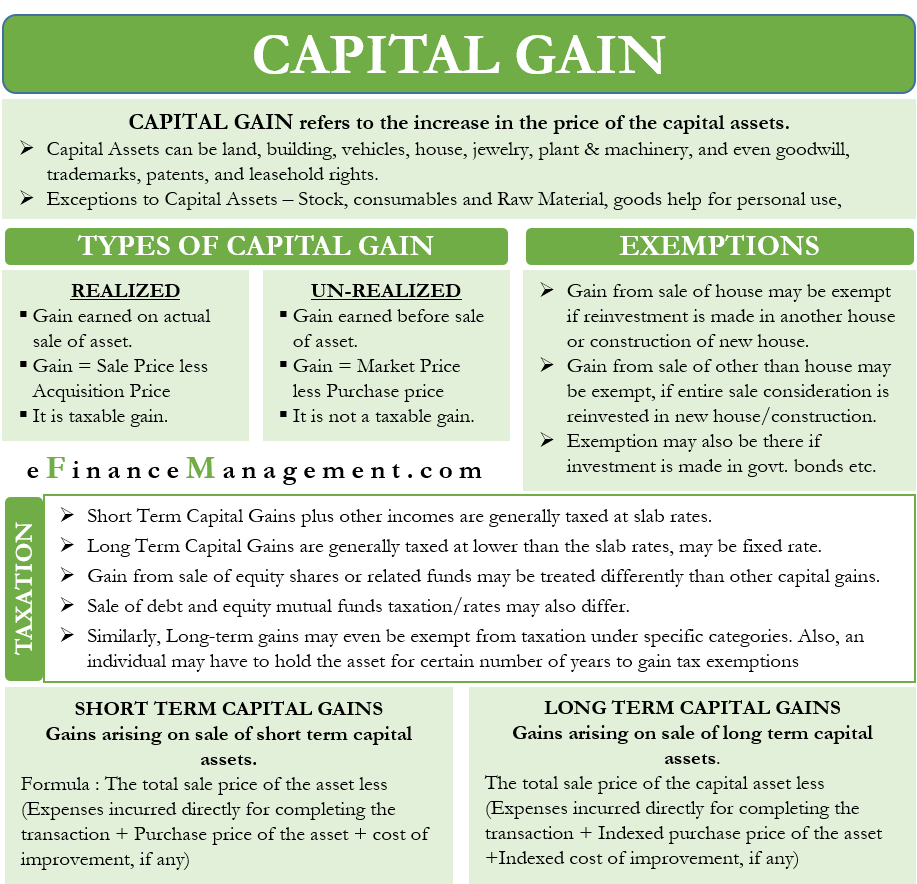

Capital Gains Meaning Types Taxation Calculation Exemptions

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

How Do Taxes Affect Income Inequality Tax Policy Center

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

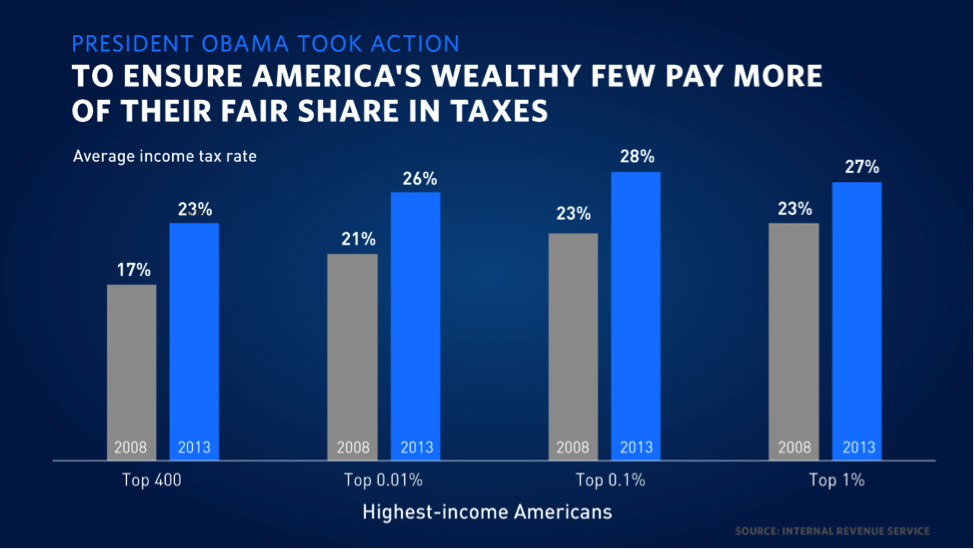

Taxing The Rich More Evidence From The 2013 Federal Tax Increase Equitable Growth

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)