when does alimony end in pa

Alimony length is usually based on length of marriage - one commonly used standard for alimony duration is that 1 year of alimony is paid every three years of marriage however this is not always the case in every state or with every judge. Some payors think alimony payments automatically end at retirement or that a court will decide to terminate payments at retirement as a matter of course but this is not necessarily so.

Finding The Right High Net Worth Boca Raton Divorce Lawyer Divorce Lawyers Divorce Petition For Divorce

They will also usually end when either spouse passes away.

. There are a number of circumstances under which alimony ends. These include when the recipient remarries dies or cohabitates. For example if youve been married for 15 years a 5-year term of alimony may be considered.

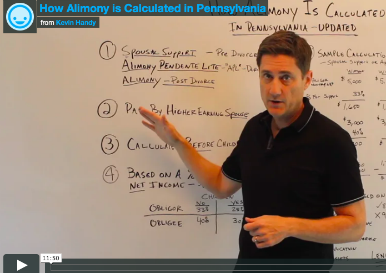

In some cases cohabitation may be a cause for the termination of alimony. In order to calculate spousal support or alimony pendente lite under the new guidelines first we take 33 of the higher earning spouses income which comes out to 1925 rounding up to the nearest dollar. This means that divorce and separation agreements signed after December 31 2018 will operate under this new law.

There is no specific law on the books in Pennsylvania to determine alimony length. It is supposed to be based on the receiving ex-spouses true financial need going forward so alimony awards can vary greatly in amount and length of time they must be paid. Spousal support sometimes called alimony is in reference to recurring monthly payments carried out by one spouse to the other when they get a divorce or are legally separated.

This article was last updated on December 1 2019 About the Author. Pennsylvania updated its spousal support formula to reflect the changes to the tax law and judges will consider the impacts of the new tax laws when deciding alimony. Court-ordered spousal support terminates automatically only on the death of either party orin Maryland and Virginia but not the Districtupon remarriage.

In Pennsylvania alimony refers to the financial support paid from one ex-spouse to another once their marriage ends and divorce is final. Alimony payments will typically end when the receiving spouse gets remarried or moves in. If the spouses cannot reach such an agreement the court may decide to order it.

So in this case alimony is not meant to unjustly enrich one party or penalize the other. A court order may result from a trial or as part of a settlement agreement adopted by a court in the judgment of divorce. Pennsylvania does allow for permanent alimony in certain situations but this type of alimony is rarely awarded by the courts.

Under the old guidelines spousal support would be 40 of 2500 the difference between 3333 and 5833 or 1000 per month. Although permanent alimony is awarded when it is intended to support a dependent spouse for the rest of his or her life there are times when it will end. Its a fact that two households are more expensive to run than one.

It would also terminate upon cohabitation by the recipient spouse or death of either party. However if the couple settled outside of court the divorce settlement must include a statement terminating alimony upon remarriage in order for it to end. However in a bill that was passed on December 20 2017 alimony payments will no longer be deductible for the payor nor taxable for the recipient here in Pennsylvania.

So Pennsylvania alimony exists in part based on the needs of the recipient party once the marriage is over and divorce is final. Pennsylvanias spousal support formula was revised to reflect the changes in tax law and judges will consider the new tax laws when calculating alimony by Pennsylvania divorce laws alimony. A paying spouse may file a motion to terminate alimony as soon as he or she learns of the supported spouses remarriage.

Alimony payments will typically end when the receiving spouse gets remarried or moves in with a new romantic partner. This is another subjective ruling based on a number of factors brought up in court. Alimony refers to payments given from one spouse to another after the divorce has been finalized.

Alimony may also be discontinued upon the remarriage or cohabitation of the receiving spouse. If spouses can agree they can put their heads together and decide on an amount of alimony and duration. The paying spouse passes away unless there is an agreement or order that says the alimony shall continue despite the death.

Alimony payments are no longer tax deductible for the paying spouse or reportable income for the recipient as of January 1 2019. When does alimony end automatically. The receiving spouse lives with a member of the opposite sex who is not a member of their family.

In such a situation the receiving spouse will need to file a motion to. In Pennsylvania alimony refers to the financial support paid from one ex-spouse to another once their marriage ends and divorce is final. The receiving spouse passes away.

It terminates when a couple reconciles or it can convert into alimony pendente lite when a divorce complaint is filed. The receiving spouse remarries. There is no automatic right or entitlement to it.

Most divorce agreements in PA do include such a provision. A rule of thumb of one year of alimony for every three years of marriage is commonly referred to. Most of the time it ends when the dependent spouse starts living with a new partner.

Beginning on January 1 2019 alimony payments are no longer tax-deductible to the paying spouse or reportable income to the recipient. In the case of remarriage a court-ordered alimony award is terminated automatically upon the receiving spouses remarriage. While you will not find this anywhere in the Divorce Code you may have heard of the lore in the five-county Greater Philadelphia area that a base line consideration for a term of alimony is one year for every three years of marriage.

Most divorce agreements in PA do include such a provision. Unlike spousal support and APL alimony is discretionary and the court would determine the nature amount and duration of alimony ifit finds that alimony is necessary. Alimony in Pennsylvania automatically terminates upon either spouses death or the supported spouses remarriage.

Alimony is not calculated by a formula in Pennsylvania. Market Your Law Firm. Call us at 1 000 000-0000.

- Moshier Law When Does Alimony End. Theoretically spousal support can last indefinitely. However this is just a rough estimate and subject to legal consideration.

However this scenario is rare in most cases. Every couples divorce and alimony arrangement will differ based upon their unique circumstances and the agreement they reach. However the paying spouse may still be obligated to continue making as many of those payments as possible after death depending on the court order.

Alimony also known as spousal support is a monthly payment that a higher-earning spouse pays to a lower-earning spouse for financial support after a divorce.

Modifying Your Alimony Are You Paying Too Much Grundung Existenzgrundung Finanzierung

Understanding Alimony In Pa In 2022 And The Challenges Of Resolving It

How Alimony Is Calculated In Pennsylvania Snapdivorce

What You Need To Know About Pennsylvania Alimony Darbouze Law Group Pittsburgh Family Lawyers

When Can You End A Lifetime Alimony Sadek And Cooper Family Law

Alimony In Pa What Can You Expect To Pay

Alimony In Pa In 2022 Definitive Guide To The Biggest Sticking Points

Learn How To Use Separable Inseparable Phrasal Verbs Child Support Payments Child Support Quotes Child Support

Alimony In Pa In 2022 Definitive Guide To The Biggest Sticking Points

How To Avoid Paying Alimony Men S Divorce Podcast Men S Divorce

Alimony And Spousal Support Experienced Family Law Attorney Lake Mary Florida

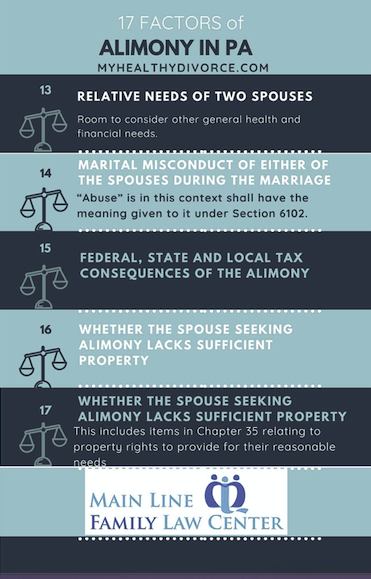

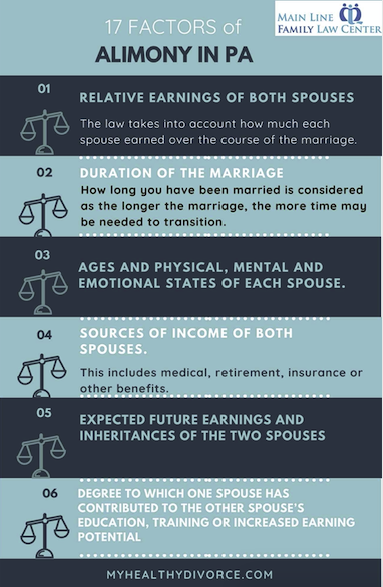

The Basics Of Alimony In Pa Relevant Factors How It Works Etc The Martin Law Firm

Alimony Attorney Jacksonville Florida Ashley Goggins Law P A

Alimony In Pa In 2022 Definitive Guide To The Biggest Sticking Points

Alimony In Pa In 2022 Definitive Guide To The Biggest Sticking Points

It Could Be A Great Time To Invest In Rental Properties According To A Recent Report That Measures The Ratio Of Wea Legal Separation Alimony Divorce Mediation

Alimony In Pa In 2022 Definitive Guide To The Biggest Sticking Points

The Basics Of Alimony In Pa Relevant Factors How It Works Etc The Martin Law Firm